Many people who grieved 2020 property assessments got at least some relief

By John T. Ryan

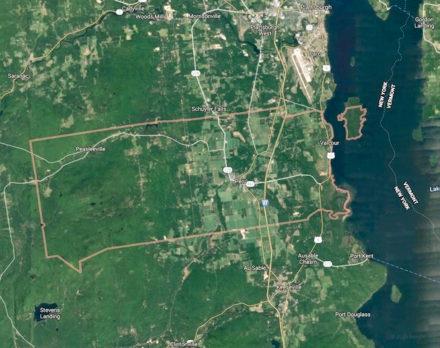

Peru – On about May 1st, the owners of 2,312 local properties received a notice that their property had a new assessed value. A few values decreased, but most increased, some significantly. Several people expressed their displeasure to the Town Board and on social media.

The notifications advised taxpayers to call assessor Jeremy Cross if they had questions and informed them of their right to file a grievance with the Peru Board of Assessment Review. Many people took that advice. After reviewing evidence and additional information, Cross changed the assessments on 108 parcels. The Board of Assessment Review received 94 grievances and approved 19 changes.

Board of Assessment Review Chair Deborah Witherwax said she’s never seen so many grievances. The Board typically meets once annually. This year it met three times with 45 people appearing in person. While the Board changed 19 assessments, if people had presented more supporting evidence, they might have been approved many more. Witherwax stated, “We denied several for lack of evidence. Some people were upset, but the majority didn’t have any evidence other than last year’s assessment. We need to see sales data for comparable properties located in the Town of Peru, i.e., a stick-built, three-bedroom, one-bath ranch, on a slab, etc. One person submitted information on a sale in the Town of Plattsburgh. That’s not acceptable. We need sales in Peru. We need as much detailed information as possible.”

Witherwax advised taxpayers who have concerns to call the assessor to ask questions and to explain why they believe the assessment is incorrect. If dissatisfied, they can file the grievance form with the Peru Board of Assessment Review. If the taxpayer is unhappy with the Board’s decision, they can appeal in Small Claims Court at the cost of $35 or NYS Supreme Court depending on the nature of the property. One, two, or three-family residences appeal to Small Claims Court.

Peru’s residential properties hadn’t undergone a total reassessment in several years. County Director of Real Property Services Martine Gonyo said up until about four years ago assessors conducted annual town-wide reassessments; however, state aid has been gradually decreasing. Consequently, the County assessors are no longer conducting annual town-wide reassessments.

Posted: June 23rd, 2020 under County Government News, General News, Northern NY News, Peru News, Peru/Regional History, Town Board News.