DiNapoli: School District and Big City Tax Levy Cap at 2% for Second Straight Year

January 12, 2023 – Property tax levy growth for school districts and the state’s biggest cities will be capped at 2%, the same as last year, according to data released today by State Comptroller Thomas P. DiNapoli.

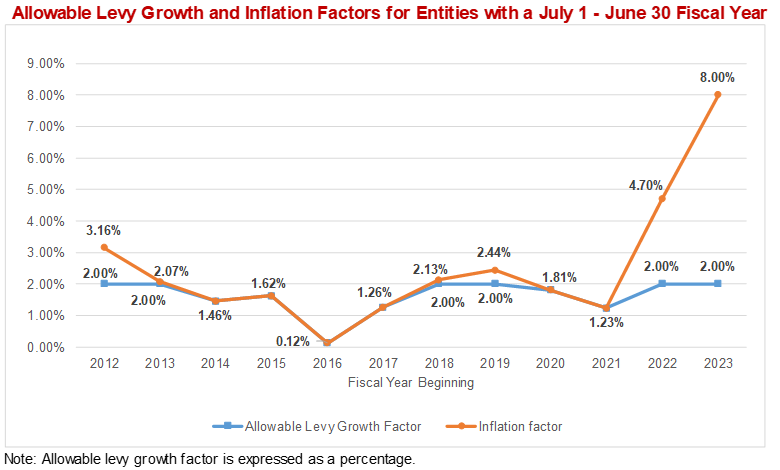

The tax cap, which first applied to local governments and school districts in 2012, limits annual tax levy increases to the lesser of the rate of inflation or 2% with certain exceptions, including a provision that allows school districts to override the cap with 60% voter approval of their budget. DiNapoli’s office calculated the inflation factor at 8% for those with a June 30, 2024 fiscal year end.

“School and local communities are still navigating the post-pandemic needs of their students and residents while dealing with high rates of inflation and employee turnover,” DiNapoli said. “School district and municipal officials must exercise fiscal prudence to stay under the cap amid these challenges as they prepare their budgets.”

The 2% allowable levy growth affects the tax cap calculations for 676 school districts and 10 cities with fiscal years starting July 1, 2023, including the “Big Four” cities of Buffalo, Rochester, Syracuse and Yonkers.

List of allowable tax levy growth factors for all local governments

Property Tax Cap: Inflation and Allowable Levy Growth Factors

Track state and local government spending at Open Book New York. Under State Comptroller DiNapoli’s open data initiative, search millions of state and local government financial records, track state contracts, and find commonly requested data.

Posted: January 12th, 2023 under Education News, State Government News, State Legislator News.